BBC Machine Learning Fireside Chat: The ML Arms Race: China vs. USA vs. Europe

BBC Machine Learning Fireside chat: The ML Arms Race: China vs. USA vs. Europe

BBC ML Fireside chats are a fairly new initiative launched by a group of machine learning specialists at the BBC. They are being held as free panel sessions open to the general public via meetup.com, where BBC ML Fireside chats have their own burgeoning group.

The 06-Jun-2018 session was the 6th or 7th held by the group and focused on the unsettling similarity between modern day artificial intelligence technological race and the not-so-distant arms and space race between the East and the West. Granted, some things *did* change between the Cold War and the present day, namely that instead of 2 key players (the US and the Soviet Union) we now have 3: the US, Russia, and China, with UK and the EU being additional important players.

The panel featured as its speakers:

Lucy Beard: a dual UK/US national, Lucy is a former actuary who then joined Intuit as a data scientist (“before we all started using the term”), and a couple of years ago had her entrepreneurial epiphany and launched Feetz, the world’s first company producing custom-fitted 3D-printed shoes. Lucy joined via Skype from California.

Charlotte Stix: Research Associate and Policy Officer for AI Policy at the Leverhulme Centre for the Future of Intelligence, University of Cambridge, and formerly a member of European Commission’s Robotics and Artificial Intelligence Unit.

Jeffrey Ding: China lead for the Governance of AI Program at the Future of Humanity Institute, University of Oxford, and formerly an advisor to the U.S. Department of State and the Hong Kong Legislative Council.

The panel was perfectly selected to discuss the complex, politically sensitive topic: Lucy, as a dual US and UK national was in the position to highlight the importance of cultural differences in development of new technologies between the US and UK / Europe; Charlotte, as an EU national living in London was the right person to discuss the impact of Brexit on UK’s science and technology scene; while Jeffrey, as American born Chinese was an ideal person to discuss both the scale of ML efforts by the 2 major players, but also to delineate some ideological considerations, and to highlight scenarios more nuanced than “the winner takes it all”.

The event was attended by approx. 100 guests from different backgrounds (diversity and inclusion side note: overwhelming majority of them were men) and the discussion flowed smoothly and energetically from the get-go. One valid point clarified at the outset was that currently “AI” and “machine learning” generally refer to different forms of intelligent automation rather than to sentient, self-conscious agents the like of HAL9000 or Ex Machina’s Ava.

It’d require a post 10 times the length of this one to transcribe the entire conversation, but the more salient points were:

We may not be in the machine learning “arms race” situation just yet, but if we keep framing the ongoing conversation like that, we might end up with one.

There is a frenzied race for ML / data science talent taking place right now, with Big Tech firms sparing no effort and no expense to compete the little talent that’s out there, leading to a very real “salary race”. (If I may add my own perspective here, this is very similar to what we’ve seen in financial services in early 2000’s, where there was a very similar race for junior investment bankers or credit derivatives specialists, or the race for iOS developers circa 2007/2008. In case of financial services, the demand was just as intense as it was short-lived, and many junior bankers and credit derivatives structuring specialists experienced on their own skins just how unsentimental banks are; in case of iOS developers the supply quickly met the demand, leading to an adjustment in wages – ML, as purely technological, may experience the latter fate; as for data science, the jury’s out, as it’s more interdisciplinary, and not purely technological).

The importance of (often marginalised) ethical considerations.

In light of the increasingly globalised and interconnected nature of computer technology, win-win scenarios are possible (Jeffrey gave an example of Microsoft’s China research hub, where the best and brightest scientists from China work for the benefit of a US company, but on the other hand, gain a lot of expertise themselves and leave to set up some of China’s leading ML companies).

EU does have quality academic and entrepreneurial hubs, developing quality research and talent, but it’s not doing a great job of promoting it and holding on to it.

UK is trying to pre-empt the impact of Brexit and maintain (if not enhance) its position in the ML / AI world by launching numerous agencies and initiatives (author’s side note: one of the examples of recently launched agencies is Fair-Space, whose head, Professor Yang Gao, was a guest in the recent Royal Institution event; one of the examples of recent initiatives are recent report by House of Lords Select Committee on AI or PM’s bold declaration to use AI in cancer detection) while at the same time, it’s facing a prospect of losing hundreds of millions of EUR per year in EU funding.

Some of the big concerns around Big Data and machine learning are in fact very 1st world types of problems – as Charlotte rightly pointed out, a typical citizen of the Global South wouldn’t care how her or his data is being used, as long as they would receive something that would improve their lives (e.g. healthcare) in return.

The session ended with a Q&A that lasted about 20 minutes, followed by networking. Had it not been for the fact that WeWork had to close the building at 21:00, the networking part could have easily lasted much longer.

It is worth mentioning that the events are organised on voluntary basis by a group of ML enthusiasts at the BBC, who put their own time and effort into making them happen. WeWork (which recently acquired meetup.com in order to enhance the brand) kindly provided the space (and catering! You don’t usually have any at paid events, let alone the free ones), and the result was absolutely great. Big “thank you” to everyone who made the event happen, especially Gabriel and Ahmed at the BBC.

In short: brilliant event. You can join the BBC Machine Learning Fireside chat group on meetup.com here.

1 reason why I really, really, REALLY hate Bitcoin

1 reason why I really, *really*, REALLY hate Bitcoin

It’s 2018 and Bitcoin is all the rage. At USD 7,000 it is perhaps less of a rage than it was at USD 20,000 in Dec-2018 (although people who bought it then… well, they must be literally “all (the) rage”), but still, this price is nothing short of astonishing.

I am an enthusiast of blockchain technology, but at the same time, I know that BitCoin and blockchain are not the same thing. The latter is, in its core, a concept, a new approach of maintaining, storing, and updating ledgers and books of records. The concept requires tangible technological solutions in order to become a real-world solution, and that is happening as we speak. A number of providers (e.g. IBM, whose solution my former employer Northern Trust used in their innovative blockchain-based solution for Private Equity) offer blockchain products. BitCoin, whilst running on a blockchain network (the first, or one of the first blockchain networks in the world, and by far and large the most successful and best-known one), has no intrinsic value at all (same applies to all other “on-chain” assets, BitCoin is in no way exceptional here).

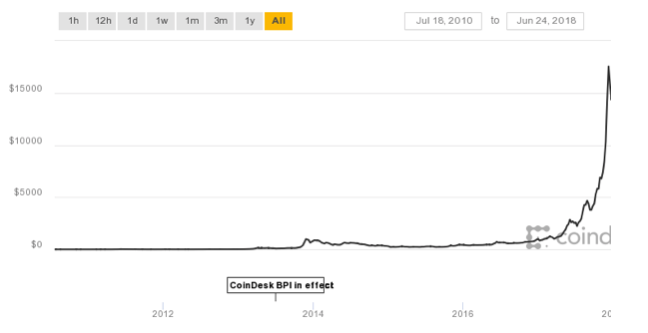

Ok, so BitCoin is a purely digital, largely unregulated*, (over)hyped, somewhat mysterious (the coin’s mysterious founder Satoshi Nakamoto certainly couldn’t predict that his decision to remain anonymous will do wonders for BitCoin’s PR and status), and first cryptocurrency of its kind. It is a speculator’s dream. Of course, for this dream to come true, BitCoin needed to catch on in the mainstream, which it did, on a scale no one could have predicted. Discussing the merits of BitCoin as an investment is like discussing the merits of a lottery ticket as an investment. Attributing to early BitCoin miners or buyers some sort of prodigious investment foresight is, frankly, ridiculous. Most of them were tech enthusiast and geeks from the depths of IT community, who were enthusiastic about the technology and were mining earliest BitCoins for fun. The second wave were speculators, who saw a developing new market and speculatively invested without caring much about the technology’s potential. There were exceptions, who seemed to be genuine BitCoin believers (most famous among them being the Winklevoss twins**), but basically, it was a speculators’ market from Day 2 onwards. And then, with some serendipity and luck, this happened:

Chart source: Coindesk.com

Chart source: Coindesk.com

NB. The peak is actually slightly understated here, BitCoin got very close to USD 20,000 on some exchanges in Dec-2018.

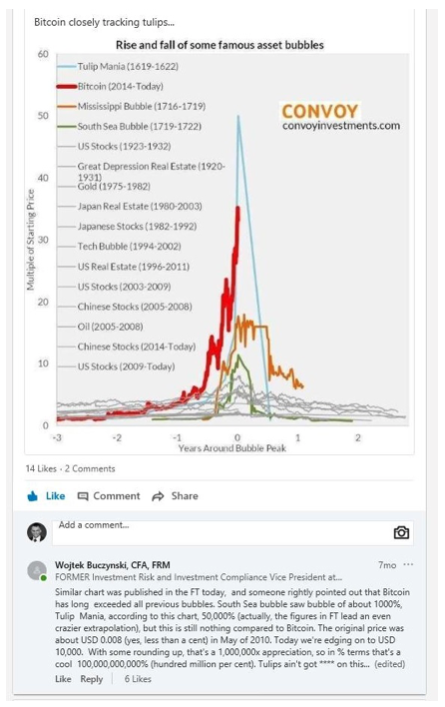

Fortunes were made, “get rich quick” seminars abounded, evangelists of “it can only go up” appeared and quickly became truly fanatical. All the conditions for an asset bubble / mania were met, and then exceeded. I’m modestly proud to be able to prove that I already held these views when BitCoin was reaching new heights on a daily, a while before its Dec-2018 peak, as can be evidenced by this LinkedIn post from late Nov-2017:

AND THAT’S FINE.

AND THAT’S FINE.

Anyone can do with their money what they see fit, and if it’s speculative BitCoin investment, so be it.****

What is decidedly *not* fine is the exponentially growing environmental cost of BitCoin mining as a result of mining operations’ energy use. The first big news (which took a lot of people, author included) by surprise was that BitCoin mining used more energy per annum than all of Ecuador. Then Ireland. Then Denmark. Then Ireland. Then more than 159 countries in the world.*****

That’s a hell of a lot of energy.

And still, this wouldn’t cause the author so much grief (no grief in fact, perhaps even some jubilation) if that energy was put to good use. Currently the algorithms miners need to crunch in order to demonstrate their proof of work and earn BitCoin transaction validation rights (which is how BitCoins are generated) don’t mean anything. They’re just complicated equations consuming enormous amounts of electricity and computing power. Which, in author’s view, shows that the closest to what can be a tangible, real-world classification of BitCoin is that of pollution derivative (which also makes BitCoin a self-referential instrument, because it’s pollution generated in the process of BitCoin mining). BitCoin is pollution, it’s as simple as that. If only, instead of solving explicitly pointless equations, the credits were given for participation in science- or healthcare-related distributed computing projects such as:

- LHC@Home: Aiding CERN’s particle research

- Einstein@Home: Detection of gravitational waves (actually, they were detected in 2015 and won a Nobel prize in 2017, but the project is still running, and my laptop is contributing to it because I saw a popular science programme about LIGO in Louisiana, I thought it was awesome, and that was that; proudly contributing my CPU power since 2016).

- SETI@Home: The original @Home project aiding search for extraterrestrial intelligence.

- Or, if they’d prefer something more human-centric, there’s always Folding@Home, whose research helps in a fight with cancer, Zika, Alzheimer’s, Parkinson’s, and several other serious, often terminal conditions.

If the computing and electric power currently used to mine BitCoin were repurposed for the purpose of science, one can only imagine how many advances we’d have achieved by now. A thorough understanding of Alzheimer’s and Parkinson’s? Advanced climate modelling? Better understanding of the human brain? A detailed 3D model of the Milky Way? Advanced mathematics? Particle physics? Nuclear fusion?

It truly boggles the mind how much good could be accomplished out of something that today goes to complete, asset-bubble-fuelled, waste. We’d get so much closer to Stage I on the Kardashev scale on this alone.

And yet this is no happening, and it doesn’t look like it will. One can blame the BitCoin foundation for this as the people who set the rules for the BitCoin network (which is a mess), but even they can’t be blamed in full. The real parties to blame are the usual suspects: greed, short-sightedness, bandwagon effect, etc.

And this is why I hate BitCoin.

PS. This article is not moaning of a sore loser. I neither lost money on BitCoin nor missed on it out altogether. In the brief period when I was allowed to trade it (i.e. approx. 2 months between jobs), I made approx. 13% by betting on BitCoin’s downfall and volatility. 13% is a negligible profit by BitCoin standards, but by real world standards it’s not too shabby. So I haven’t missed out, and if I still could hold my positions, I’d have made much more than 13% by holding on to my all-short position. Still, on risk-return basis, this wasn’t a very good return.

* That’s perhaps not entirely true: South Korea flirted with the idea of banning cryptocurrency trading via anonymised accounts (mostly concerned about money laundering and concerns over its citizens gambling away their savings) around Jan-2018 before deciding not to proceed; China banned ICO’s and cryptocurrency trading in full in Jan-2018; India introduced a similar ban in Feb-2018

BUT…

- This is an incredibly fast-moving market, and any government / regulatory restrictions may be lifted just as quickly as they were applied

- For purely digital assets (which they are) the restrictions can be easily bypassed: VPN access to a network of a country that doesn’t prohibit crypto trading, a TOR browser, an exchange permitting anonymised accounts. Obviously, these activities will constitute a breach of the law, but at the same time, they will be fairly difficult to detect.

** The author doesn’t usually feel sorry for people who got USD 65mln as a court payout, but he couldn’t help but feel that they walked from the Facebook affair somewhat shortchanged. Therefore their early investment in BitCoin (some would say lucky, but they appeared to be solid believers back in 2013, so they deserve some kudos) and its subsequent exorbitant rise in value (100,000 coins worth, at the Dec-2018 peak, close to USD 2bn) was welcome. As a reminder, their idea for a BitCoin ETF (which isn’t that much different to existing BitCoin futures and their offshoots on financial spread betting platforms) was met with reactions best captured in this ZeroHedge article***.

*** The author doesn’t like or read ZH since approx. 2014, when it was becoming more political and less financial, but in its heyday it had one hell of news and commentary.

**** The author believes there will be a lot of tears, buyers’ remorse, and fortunes and savings lost sooner rather than later.

***** The Digiconomist blog has an ongoing analysis of BitCoin’s energy consumption. Another good analysis can be found on PowerCompare.