1 reason why I really, *really*, REALLY hate Bitcoin

It’s 2018 and Bitcoin is all the rage. At USD 7,000 it is perhaps less of a rage than it was at USD 20,000 in Dec-2018 (although people who bought it then… well, they must be literally “all (the) rage”), but still, this price is nothing short of astonishing.

I am an enthusiast of blockchain technology, but at the same time, I know that BitCoin and blockchain are not the same thing. The latter is, in its core, a concept, a new approach of maintaining, storing, and updating ledgers and books of records. The concept requires tangible technological solutions in order to become a real-world solution, and that is happening as we speak. A number of providers (e.g. IBM, whose solution my former employer Northern Trust used in their innovative blockchain-based solution for Private Equity) offer blockchain products. BitCoin, whilst running on a blockchain network (the first, or one of the first blockchain networks in the world, and by far and large the most successful and best-known one), has no intrinsic value at all (same applies to all other “on-chain” assets, BitCoin is in no way exceptional here).

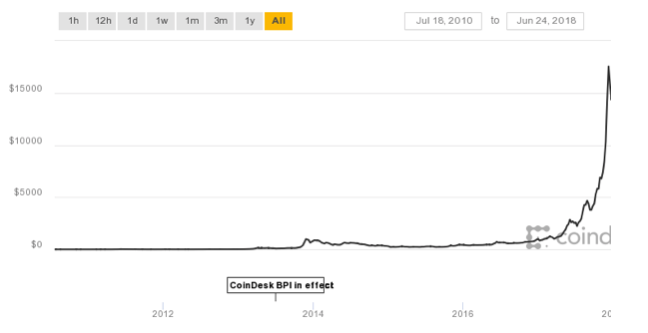

Ok, so BitCoin is a purely digital, largely unregulated*, (over)hyped, somewhat mysterious (the coin’s mysterious founder Satoshi Nakamoto certainly couldn’t predict that his decision to remain anonymous will do wonders for BitCoin’s PR and status), and first cryptocurrency of its kind. It is a speculator’s dream. Of course, for this dream to come true, BitCoin needed to catch on in the mainstream, which it did, on a scale no one could have predicted. Discussing the merits of BitCoin as an investment is like discussing the merits of a lottery ticket as an investment. Attributing to early BitCoin miners or buyers some sort of prodigious investment foresight is, frankly, ridiculous. Most of them were tech enthusiast and geeks from the depths of IT community, who were enthusiastic about the technology and were mining earliest BitCoins for fun. The second wave were speculators, who saw a developing new market and speculatively invested without caring much about the technology’s potential. There were exceptions, who seemed to be genuine BitCoin believers (most famous among them being the Winklevoss twins**), but basically, it was a speculators’ market from Day 2 onwards. And then, with some serendipity and luck, this happened:

Chart source: Coindesk.com

Chart source: Coindesk.com

NB. The peak is actually slightly understated here, BitCoin got very close to USD 20,000 on some exchanges in Dec-2018.

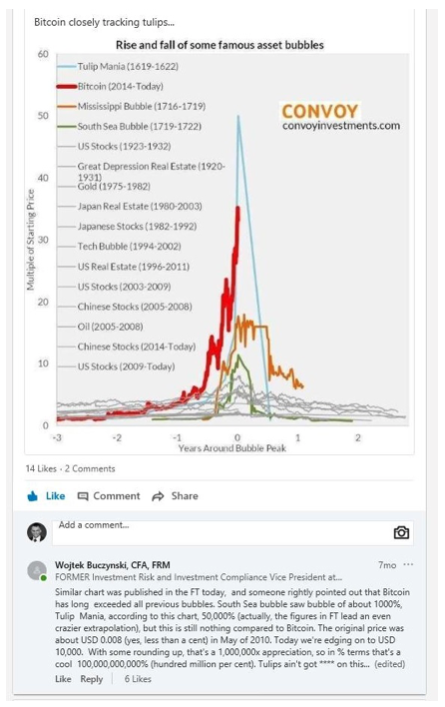

Fortunes were made, “get rich quick” seminars abounded, evangelists of “it can only go up” appeared and quickly became truly fanatical. All the conditions for an asset bubble / mania were met, and then exceeded. I’m modestly proud to be able to prove that I already held these views when BitCoin was reaching new heights on a daily, a while before its Dec-2018 peak, as can be evidenced by this LinkedIn post from late Nov-2017:

AND THAT’S FINE.

AND THAT’S FINE.

Anyone can do with their money what they see fit, and if it’s speculative BitCoin investment, so be it.****

What is decidedly *not* fine is the exponentially growing environmental cost of BitCoin mining as a result of mining operations’ energy use. The first big news (which took a lot of people, author included) by surprise was that BitCoin mining used more energy per annum than all of Ecuador. Then Ireland. Then Denmark. Then Ireland. Then more than 159 countries in the world.*****

That’s a hell of a lot of energy.

And still, this wouldn’t cause the author so much grief (no grief in fact, perhaps even some jubilation) if that energy was put to good use. Currently the algorithms miners need to crunch in order to demonstrate their proof of work and earn BitCoin transaction validation rights (which is how BitCoins are generated) don’t mean anything. They’re just complicated equations consuming enormous amounts of electricity and computing power. Which, in author’s view, shows that the closest to what can be a tangible, real-world classification of BitCoin is that of pollution derivative (which also makes BitCoin a self-referential instrument, because it’s pollution generated in the process of BitCoin mining). BitCoin is pollution, it’s as simple as that. If only, instead of solving explicitly pointless equations, the credits were given for participation in science- or healthcare-related distributed computing projects such as:

- LHC@Home: Aiding CERN’s particle research

- Einstein@Home: Detection of gravitational waves (actually, they were detected in 2015 and won a Nobel prize in 2017, but the project is still running, and my laptop is contributing to it because I saw a popular science programme about LIGO in Louisiana, I thought it was awesome, and that was that; proudly contributing my CPU power since 2016).

- SETI@Home: The original @Home project aiding search for extraterrestrial intelligence.

- Or, if they’d prefer something more human-centric, there’s always Folding@Home, whose research helps in a fight with cancer, Zika, Alzheimer’s, Parkinson’s, and several other serious, often terminal conditions.

If the computing and electric power currently used to mine BitCoin were repurposed for the purpose of science, one can only imagine how many advances we’d have achieved by now. A thorough understanding of Alzheimer’s and Parkinson’s? Advanced climate modelling? Better understanding of the human brain? A detailed 3D model of the Milky Way? Advanced mathematics? Particle physics? Nuclear fusion?

It truly boggles the mind how much good could be accomplished out of something that today goes to complete, asset-bubble-fuelled, waste. We’d get so much closer to Stage I on the Kardashev scale on this alone.

And yet this is no happening, and it doesn’t look like it will. One can blame the BitCoin foundation for this as the people who set the rules for the BitCoin network (which is a mess), but even they can’t be blamed in full. The real parties to blame are the usual suspects: greed, short-sightedness, bandwagon effect, etc.

And this is why I hate BitCoin.

PS. This article is not moaning of a sore loser. I neither lost money on BitCoin nor missed on it out altogether. In the brief period when I was allowed to trade it (i.e. approx. 2 months between jobs), I made approx. 13% by betting on BitCoin’s downfall and volatility. 13% is a negligible profit by BitCoin standards, but by real world standards it’s not too shabby. So I haven’t missed out, and if I still could hold my positions, I’d have made much more than 13% by holding on to my all-short position. Still, on risk-return basis, this wasn’t a very good return.

* That’s perhaps not entirely true: South Korea flirted with the idea of banning cryptocurrency trading via anonymised accounts (mostly concerned about money laundering and concerns over its citizens gambling away their savings) around Jan-2018 before deciding not to proceed; China banned ICO’s and cryptocurrency trading in full in Jan-2018; India introduced a similar ban in Feb-2018

BUT…

- This is an incredibly fast-moving market, and any government / regulatory restrictions may be lifted just as quickly as they were applied

- For purely digital assets (which they are) the restrictions can be easily bypassed: VPN access to a network of a country that doesn’t prohibit crypto trading, a TOR browser, an exchange permitting anonymised accounts. Obviously, these activities will constitute a breach of the law, but at the same time, they will be fairly difficult to detect.

** The author doesn’t usually feel sorry for people who got USD 65mln as a court payout, but he couldn’t help but feel that they walked from the Facebook affair somewhat shortchanged. Therefore their early investment in BitCoin (some would say lucky, but they appeared to be solid believers back in 2013, so they deserve some kudos) and its subsequent exorbitant rise in value (100,000 coins worth, at the Dec-2018 peak, close to USD 2bn) was welcome. As a reminder, their idea for a BitCoin ETF (which isn’t that much different to existing BitCoin futures and their offshoots on financial spread betting platforms) was met with reactions best captured in this ZeroHedge article***.

*** The author doesn’t like or read ZH since approx. 2014, when it was becoming more political and less financial, but in its heyday it had one hell of news and commentary.

**** The author believes there will be a lot of tears, buyers’ remorse, and fortunes and savings lost sooner rather than later.

***** The Digiconomist blog has an ongoing analysis of BitCoin’s energy consumption. Another good analysis can be found on PowerCompare.